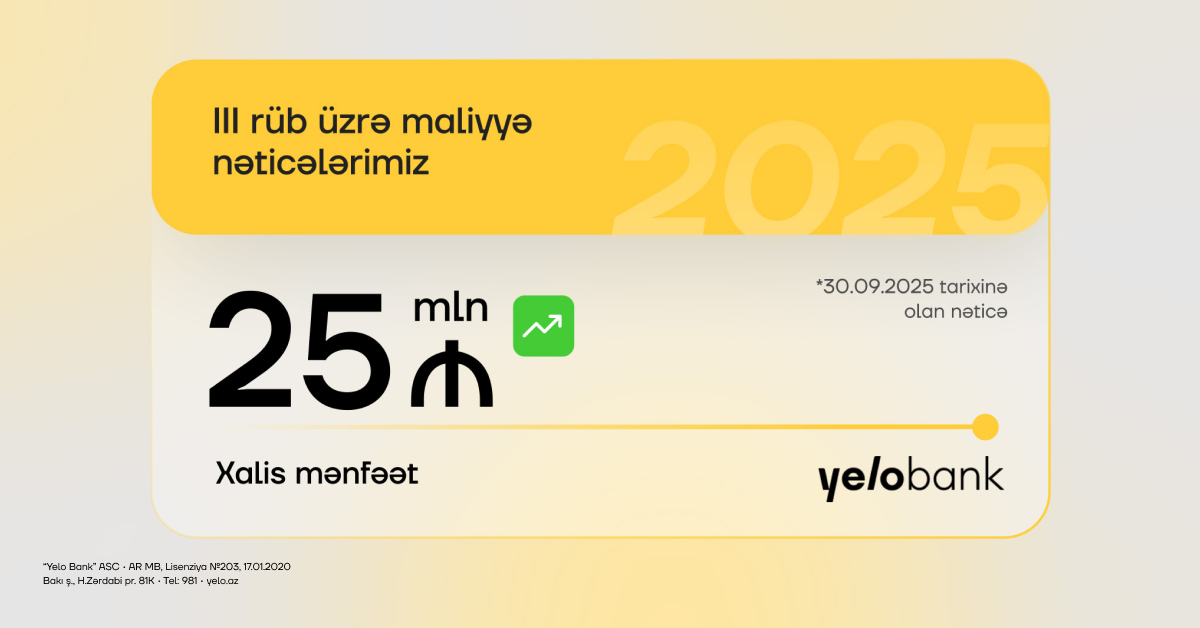

Yelo Bank has announced its financial results for the first nine

months of 2025. The positive momentum in the Bank’s key financial

indicators continued throughout the third quarter. During this

period, Yelo Bank earned a profit of approximately 25 million

manats. Notably, both the deposit and loan portfolios exceeded 1

billion manats.

Since the beginning of the year, the loan portfolio has grown by

more than 12%, reaching 1 billion 53 million manats. In line with

the Bank’s priorities, the share of business loans within the total

loan portfolio continued to expand.

In the first nine months of 2025, entrepreneurs received 474

million manats in business loans. As a result, the business loan

portfolio surpassed 646 million manats, reflecting an increase of

59 million manats, or 10%, since the start of the year.

Supporting microbusinesses in the regions remains a key focus for

the Bank. During the reporting period, 305 million manats were

allocated to this segment. Overall, the microbusiness loan

portfolio grew by 48.6 million manats, or 14%, reaching 395 million

manats by the end of the quarter.

Over the same period, more than 284 million manats in consumer

loans were issued. Consequently, the consumer loan portfolio

exceeded 407 million manats, an increase of 60 million manats, or

more than 17%, compared to the beginning of the year. Importantly,

40% of this portfolio growth and 38% of sales were generated

through online channels.

Yelo Bank’s deposit portfolio also demonstrated solid growth.

Compared to the end of last year, deposits increased by 111 million

manats, or 12%, reaching 1 billion 40 million manats at the end of

the third quarter. A significant portion of this growth came from

individual deposits, underscoring the attractiveness of the Bank’s

products and services.

The Bank’s capital position strengthened further, with total

capital reaching 168 million manats during the reporting period—13%

higher than at the beginning of the year. The total capital

adequacy ratio stood at 13.68%, while the Tier 1 capital adequacy

ratio was 9.93%, both exceeding regulatory requirements. By the end

of the quarter, the Bank’s assets had increased by 12% to 1 billion

444 million manats. Interest income surpassed 130 million manats,

while non-interest income exceeded 11 million manats.

Anar Hasanov, Chairman of the Board of Yelo Bank, commented on the

results: “The results of the first nine months of 2025 demonstrate

that Yelo Bank is confidently advancing towards its strategic

goals. Our financial indicators—loan and deposit portfolios

exceeding 1 billion manats, along with growth in capital and

assets—confirm the successful execution of our plans. In line with

the challenges of the new strategic period, we continue to build a

banking environment that creates added value and strengthens

customer loyalty. Our digital solutions not only simplify access to

financial services but also provide significant support for the

sustainable growth of businesses. These achievements are not

coincidental—they are the result of the dedication of our

professional team and the trust placed in us by our customers. We

are confident that together we will reach even greater milestones

in the future.”

Need more information about our banking services? Then call 981 or

visit our Facebook,

Instagram,

Whatsapp,

or yelo.az accounts.

Yelo Bank – Brighter Banking!

Yelo Bank ends the third quarter with profit